By Erik Hertzberg

(Bloomberg) — Inflation in Canada cooled less than expected last month, supporting the Bank of Canada’s decision to move to the sidelines after back-to-back rate cuts.

Headline inflation decelerated to 2.2% in October, Statistics Canada data showed Monday, driven by a faster yearly decrease in gasoline costs.

That’s above the median projection in a Bloomberg survey of economists, who were expecting yearly price pressures to slow to a 2.1% yearly clip, from 2.4% in September.

On a monthly basis, the consumer price index rose by 0.2%, matching expectations.

The Canadian dollar weakened to trade at C$1.4036 against the U.S. currency, while the two-year government bond yield was 2.485% as of 9:41 a.m., little changed on the day. Traders in overnight swaps continued to put the odds of a rate cut at the central bank’s Dec. 10 meeting at less than 5%.

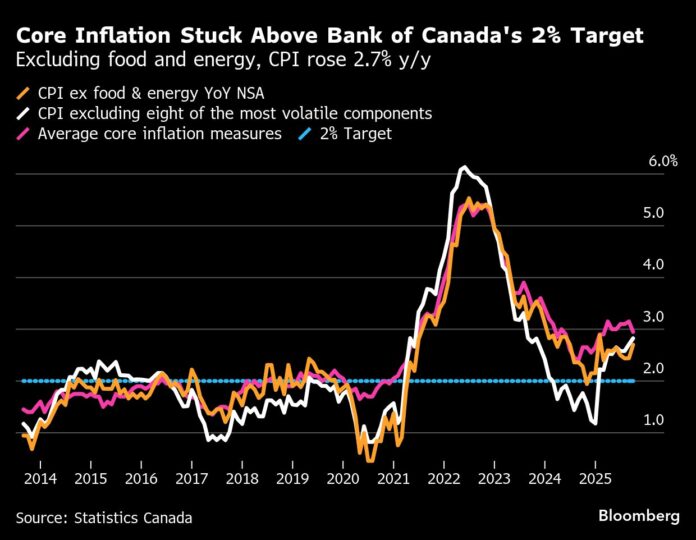

The report showed conflicting signals for core inflation. The Bank of Canada’s trim and median gauges decelerated to a 2.95% yearly clip, from 3.1% previously. On a three-month moving annualized basis, those measures slowed to 2.6%, from 2.7% in September.

The breadth of inflationary pressures also narrowed, with about 34% of items in the consumer price index rising above a 3% yearly pace, from 38% previously.

But excluding food and energy, prices rose 2.7% from a year earlier, up from 2.4% in September. The bank’s previous measure of core inflation — CPI excluding eight volatile components and indirect taxes — also accelerated to 2.9%.

Combined, the report shows headline inflation trending back toward the central bank’s 2% target, but core measures are sticking in the top part of policy-makers’ control band for price pressures.

“Broadly speaking, it still speaks to an inflation dynamic that is trending weaker. We have a weak economy as well,” Jimmy Jean, chief economist at Desjardins, said on BNN Bloomberg Television. “And so that will continue to make the Bank of Canada comfortable in terms of its monetary policy.”

Officials led by Governor Tiff Macklem cut interest rates to 2.25% last month as the economy continues to take damage from the trade war, but signaled reluctance to ease borrowing costs further, saying their ability to help the economy was limited by the potential for higher inflation stemming from the trade dispute.

Policy-makers said rates were at “about the right level” as long as the economy and inflation evolved in line with their expectations.

“While inflation decelerated in October, the move was in line with expectations,” Andrew Grantham, economist at Canadian Imperial Bank of Commerce, said in a report to investors.

“It would take a longer period of easing price pressures, combined with indications of economic growth deteriorating again, to bring the Bank of Canada back off the sidelines. We continue to forecast no change in the overnight rate through to the end of next year,” Grantham added.

Shelter prices were a major contributor to monthly price pressures, rising 0.6% and driven by rental costs and insurance. On a yearly basis, shelter is up 2.5% from a year earlier.

Food prices fell 0.3% on the month, but are up 3.4% on the year.

In recent months, the bank warned that markets may be putting too much emphasis on its two “preferred” core inflation measures, the so-called trim and median gauges.

–With assistance from Mario Baker Ramirez and Anya Andrianova.

©2025 Bloomberg L.P.

Visited 332 times, 332 visit(s) today

Bank of Canada bloomberg CPI inflation Dashboard economic indicators economic news inflation statcan inflation statistics canada

Last modified: November 17, 2025