In general, I like to play contrarian because it’s nice to consider alternative viewpoints.

Instead of simply regurgitating the same take, sometimes going against the grain can pay off.

In fact, the consensus often gets it wrong, whether it’s the trajectory of home prices or the direction of mortgage rates.

The latest expected headwind for mortgage rates dropped late Friday when Moody’s downgraded the United States’ credit rating.

But if we zoom out a tad, this could end of helping mortgage rates. Allow me to explain.

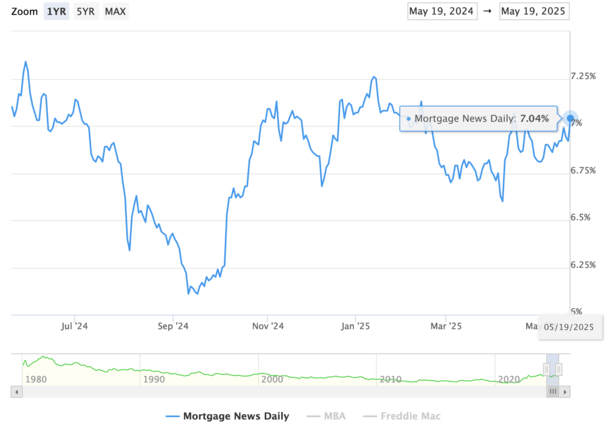

Initial Reaction Isn’t Great, Mortgage Rates Back Above 7%

The 30-year fixed is back above 7%, again (again!), per the latest daily reading from Mortgage News Daily.

It has been seesawing around these levels for a while now, and it’s yet another gut punch for prospective home buyers.

Again, no huge difference between a rate of 6.875% and 7% in terms of monthly payment, but the psychology can be brutal.

Seeing a 7 instead of a 6 while also possibly being stretched to begin with isn’t good for borrowers or the wider housing market.

As such, mortgage applications might face even more of an uphill battle as the spring home buying market begins to fizzle.

I should also note that the 30-year fixed is now only five bps below its year-ago levels. So lower mortgage rates are no longer a feature of the 2025 spring home buying season.

Mortgage Rate Spreads Got Worse on the Downgrade News

What’s interesting is the 10-year bond yields that dictate mortgage rates barely increased since the Moody’s news was announced.

Yields on the bellwether bond were up less than five basis points (bps) today, which would indicate relatively flat mortgage rates.

Instead, the 30-year fixed was up a sizable 12 bps to 7.04%, per MND. In other words, mortgage spreads widened fairly aggressively on the news.

The spread between the 30-year fixed and the 10-year bond yield has historically been around 170 bps.

This is the premium investors demand for taking a risk on a borrower’s home mortgage versus a guaranteed government bond.

In recent years this spread widened as the Fed stopped buying mortgages and volatility increased.

Spreads got really wide (over 300 bps) before coming down to the lower 200 range, but jumped back above 250 bps again.

So investors are demanding more premium above Treasuries to buy mortgage-backed securities (MBS), though this could moderate as time goes on.

But the fact that it was mostly spreads, and less so yields rising, is a positive sign regarding the credit downgrade, at least in my mind.

What Does Moody’s Downgrade Mean for Mortgage Rates?

As you can see, the early reaction wasn’t positive for mortgage rates, but as I pointed out, it’s mostly worsened spreads.

After the dust settled, 10-year Treasuries have come down quite a bit, reaching 4.56% before settling around 4.49%.

It arguably helped that Moody’s announced the United States downgrade late on Friday.

That gave the market time to digest the news without having to make any kneejerk reactions.

Had they announced the move in the morning, or midweek, chances are markets would have been pretty rattled.

Instead, traders (and the media) were given a couple days to make sense of it all and draw their own conclusions.

And at last glance the stock market was holding up pretty well, with the Dow up on the day and the S&P 500 about flat.

That’s pretty good considering all the doom and gloom that was swirling a couple days ago when the news was announced.

Ultimately, Moody’s simply matched other rating agencies who had already cut the U.S. rating years ago.

Standard & Poor’s downgraded the U.S. rating from its top tier AAA to AA+ all the way back in August 2011.

And Fitch Ratings did the same in August 2023. So Moody’s was merely catching up with the others.

As for why, Moody’s said “large fiscal deficits will drive the government’s debt and interest burden higher.”

In short, too much government spending, too much debt, and rising interest payments on said debt.

But here’s why that could wind up being a good thing for mortgage rates. The ratings agency is basically telling the government to get its act together.

They held out as long as they could, but finally downgraded the U.S., perhaps as a warning to do better. To make changes before things get even worse.

So in my mind, while everyone is reporting that the 30-year fixed is back above 7%, I’m optimistic that it may force lawmakers to rein it in.

This development could actually push politicians to make more concessions on the “big, beautiful bill” so spending and Treasury issuance doesn’t spiral out of control.

And in the process, that could actually help ease bond yields and in turn lead to lower mortgage rates.

Just note that it might not be immediate, so this could present yet another near-term headwind.