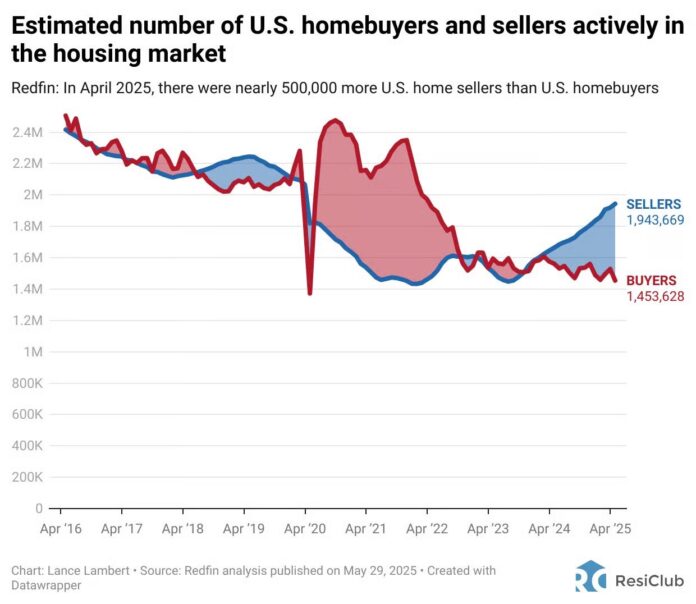

Over the past year, the gap between the number of active sellers and active buyers has widened to its largest margin since the wake of the Great Recession. According to Redfin, as of April 2025, sellers outnumbered buyers nearly 4 to 3, with a full 500,000 more selling their homes than looking to buy one.

This does not mean that another real estate-driven financial crisis is approaching (mostly due to stronger borrowers with low-interest, fixed loans, unlike the subprime teaser rates of pre-2008). But it does clearly indicate that the real estate market is softening. And this comes at an inopportune time, as a silent crisis has been eroding the cash flow of real estate investors for several years now: the operating cost crisis.

While I rarely see it discussed openly, every investor I’ve talked to recently has felt the squeeze that operating costs have put on our businesses. Just take a look at how much various operating costs have gone up in 2024:

- Property taxes nationwide went up an average of 5.1%

- Home insurance went up an average of 10.4%

- Meanwhile, wages went up 4.2% as of March

All these are substantially higher than the current inflation rate.

Some price growth has actually moderated, but only after enormous increases in the past few years. For example, construction material prices only went up only 1.3% in 2024, but that’s after increases in 2021 and 2022 of 14.6% and 15%, respectively. Gas prices have actually come down for two straight years, but are still over 50% higher than they were in 2021. Electricity rates only increased 0.9%, but that was after a 12.1% surge in 2022.

Furthermore, with the recent federally mandated switch from using R-410A to R-454B AC units, HVAC prices are likely to rise dramatically.

Meanwhile, asking rents only increased 0.4% year over year as of February.

And this could get even worse with the potential fallout of the new tariffs or further instability in the Middle East.

All this is happening in a market where home prices are still, at least nominally, higher than they’ve ever been, and interest rates are as high as they’ve been since the late ‘90s. And refinancing is usually cost-prohibitive.

Many have concluded that the BRRRR strategy simply doesn’t work right now, and I tend to agree. But we and many others still have a lot of rentals, and it’s getting harder and harder to keep them cash flowing.

So let’s dive into some of the best ways to ensure they do keep cash flowing, even in this very challenging environment. We’ll start by looking at ways to cut operating costs.

First up is debt service.

Reamortizing Loans as They Renew at Higher Rates

When interest rates shot up in mid-2022, there were many doomsayers who thought the market was going to collapse. This thought was based on a fundamental misunderstanding of the situation, given the low-interest, fixed loans that every homeowner had put no downward pressure on prices.

Unfortunately, most investors don’t have 30-year fixed mortgages. They are usually fixed for five years. So when those renewals hit, your interest rate, and thereby your mortgage payment, spike. This was a large factor in the multifamily recession in 2023 and 2024.

These days, whenever one of our loans is up for renewal, we ask to reamortize or recast the loan. In short, we reset the amortization at the beginning as if we were refinancing it.

Given the principal has been paid down and prices have gone up, our banks have been willing to do this without a new appraisal or refinance fees. On one portfolio loan, for example, our interest rate reset from 4.25% to 8%! Yet because we reamortized it, our payment actually went down.

It would work something like this. Say you had a $1 million loan at 4% interest, amortized over 25 years. The payment would be $5,278/month. If it renewed at 6.75% (where rates are as of this writing), the payment would jump to $6,909/month. That’s almost $1,700 more, which is the difference between being in the black and red for many.

However, after five years at the first renewal, the principal would have been paid down to $871,046. After 10 years, on the second renewal, it would be down to $713,594.

Despite the loan being at $871,046, your payments are still based on the original $1 million principal. By reamortizing the loan, your payments are based on a loan of $871,046. So it would look like this:

- Original principal: $1 million

- Original payment (4%): $5,278/month

- New payment (6.75%): $6,909/month

Then:

- First renewal principal (6.75%): $871,046

- First renewal payment (6.75%): $6,018/month

Then:

- Second renewal principal (6.75%): $713,594

- Second renewal payment (6.75%): $4,930/month

Yes, you will pay off less principal, but in a market where cash flow is more and more difficult to come by, that is really a secondary concern. Even after just five years, the increased payment after reamortization is less than half what it would have been. At the 10-year mark, the payment would be less, despite the interest rate going up almost three percentage points.

Of the six different banks we work with, only one has said no. And that was on a small loan that we originated with another bank that was bought out. While large national banks may not be willing to do this, most local banks will. It’s definitely worth asking.

Selling Cash Flow Losers

While the market has become more of a buyer’s market, it has by no means shut down. So it would still be worth looking through your portfolio to see if there are any properties that no longer make sense to hold. We did this after interest rates went up, and then after property taxes were jacked through the roof in 2023 in Jackson County, MO, where most of our properties are.

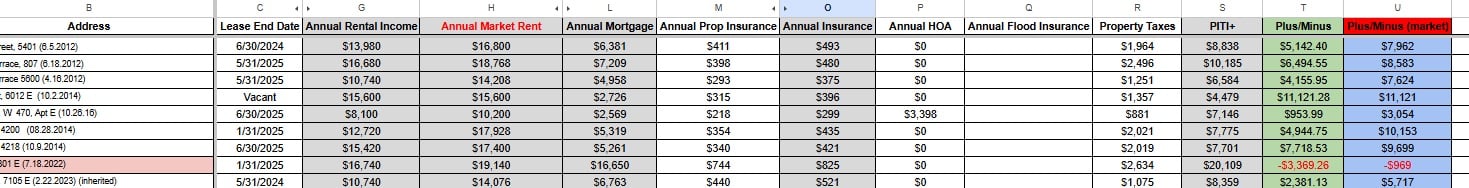

We came up with a way of measuring the fixed costs associated with the property and then a ballpark of their variable costs, and then compared that to current and market rent.

The fixed costs included:

- Mortgage payments

- Property taxes

- Property insurance

- Flood insurance, if any

- HOA fees, if any

Variable costs included maintenance, turnover, and vacancy. (We manage ourselves, so didn’t include that in the equation).

The sheet looks like this, with conditional formatting used to highlight any property that came out negative in red:

The sheet goes on to make estimates for maintenance, turnover, and vacancy costs based on the age and size of the property. But just here, you can see one property was negative without even including those costs.

This condo was hurt by the tax increase and an HOA fee increase in the same year. By far, we found the ones that don’t cash flow are large houses (particularly older ones) and condos (because of the HOA fee). So one by one, we’ve been putting those on the chopping block.

We also decided to sell properties that were over a 30-minute drive from our office, as they stressed our property management resources, as well as houses that still had a private loan on them (as we didn’t have a chance to reach the refinance stage of the BRRRR method before interest rates increased).

Regardless of the exact criteria you use, it would be worth trying to rightsize your portfolio for cash flow, if you haven’t done it already.

Challenging Tax Increases and Rebidding Insurance

As noted, property taxes went crazy in Jackson County in 2023. Ours went up an average of 67%! However, after challenging them, I got them down to a still-crazy-but-more-reasonable 39%. Those savings are incredibly important.

Even during normal years, it’s worth going through your tax assessments carefully and challenging any that seem high.

You should also not assume you are getting the best price for property insurance available. I heard numerous horror stories of property insurance going through the roof last year (including on my personal residence), but our company’s prices didn’t budge. This was because our insurance broker was able to create a Frankenstein’s monster of a policy by slicing and dicing our portfolio amongst five different insurers.

Needless to say, he built a lot of loyalty with us.

At a minimum, it’s worth shopping your portfolio every year or two. That’s how we found our current broker. We asked for quotes from four or five insurance companies and ended up saving something like 20%. These kinds of savings can be critical.

Run a Cost Audit

Every year, we run a companywide cost audit to find things we shouldn’t be paying for or are paying too much for. Two years ago, we found that we were paying TextMyBiz something like $30/month for a service we never used. OK, that’s not a lot, but we were paying for no reason, and such things can add up.

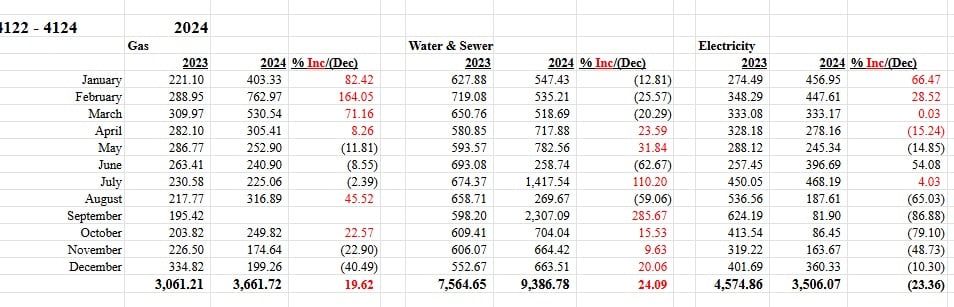

We also looked closely at all the properties we pay the utilities on and found several with water bills that were way too high. We got those leaks addressed promptly. So we now monitor all of their utility expenses against previous years to look for discrepancies.

Remember, it’s important to look for both things you should not be paying for and things you are paying too much for. It’s also worth creating budgets and KPIs so you can track and curtail expenses.

Please note, however, there are some costs you should never cut. Like tenant screening—never cut that!

Utilizing Technology to Reduce Expenses

There are countless technological solutions that can be used to reduce costs. ShowMojo or Rently are much cheaper than leasing agents. AI or Fiverr can be used for graphic design and to create logos, as well as help with writing property descriptions, employment ads, etc. AI Chatbots can answer simple questions for prospects. DocuSign can reduce the costs of office supplies. Smart thermostats or leak detectors can reduce utility costs, particularly on larger and commercial units that you pay the utilities for. In dangerous areas, the cost of security equipment, like SimpliSafe, has fallen dramatically in recent years.

And if your properties are spread out, an electric vehicle can save on gas.

It would definitely be worth spending some time brainstorming how technology can cut a variety of operating costs across the board.

Hiring Instead of Paying Contractors

This would only make sense for those with a fairly large portfolio. But broadly speaking, if you hire good construction guys and manage them well, they will be less expensive than contractors.

That being said, that’s a lot of ifs. And we’ve been on the wrong side of that equation before.

If nothing else, we’ve been able to extend the life of our HVAC and stop damages from accumulating with preventative maintenance inspections. You would like to trust tenants to replace their furnace filters and call maintenance when there are leaks. But unfortunately, that is most often not the case. Doing it yourself ensures those systems are protected and problems that could cause major damage get nipped in the bud.

Discounts and Standardization

Another thing to consider is trying to buy all the materials for your contractors yourself. The more you buy, the more discounts you get from places like Home Depot through their Pro Xtra program. In addition, you should join your local Real Estate Investors Association, as they have a two percent discount with Home Depot for REIA members. And of course, BiggerPockets Pro members get similar benefits.

Furthermore, it’s important to standardize here as much as possible. Use the same few paint colors and flooring so it’s easier to match. And look into buying in bulk when possible for additional savings.

Take Advantage of Real Tax Benefits

There are a lot of tax advantages for long-term real estate investors: depreciation, cost segregation, carried forward loss, 1031 exchanges, stepped up basis, etc.

Make sure you and your accountant are taking advantage of all of these to keep your income taxes low or nonexistent.

Managing Yourself

There are costs and benefits to managing properties yourself. But if you don’t have a huge portfolio, have sufficient time, and are riding close to the line or (more likely) your property manager isn’t doing a good job, this could be a good option.

Your typical property manager charges 10 percent of collected rents, all late fees, and the first month’s rent for new tenants. Your time isn’t free, so don’t think you are saving all that by managing yourself. But, the cash savings could very well make up for the time and energy costs in some situations.

Increasing Income

Increasing income is just as good a way to solve an operating costs crisis as cutting costs, so let’s look at a few ideas there, too.

Keep Raising Rents

This sounds like a no-brainer, but it’s important to keep raising rents as costs go up. This is particularly true if you have high occupancy. In fact, the higher the occupancy, the more aggressive you should tend to be on rent increases. (Having an occupancy that is “too high,” i.e., over 95 percent, is a sign your rents are too low in fact).

It’s also worth looking at any under-rented properties you may have, especially those that you bought with inherited residents who have lower-than-market rents but need work. I absolutely hate doing this, but it’s probably time to consider asking them to leave to actually fix up the property and rent it for what it’s worth.

STR, MTR, and Rent by the Room

Short-term rentals have become a huge industry in the last 10years. Airbnb is valued at $85 billion, for example. In certain cases, it makes absolute sense to switch properties you have over to STR, especially if they are in urban centers or vacation spots.

Medium-term rentals are also becoming more and more popular and something to consider in certain situations. That being said, you need to watch out for two things with these:

- The costs to furnish them can be significant.

- Local regulations are becoming more and more strict, so check your local laws carefully.

And let us not forget that switching homes to student rentals near colleges can also be very lucrative. In fact, it’s how my father got started in real estate.

Lastly, in a time when affordability is a huge issue for people, renting out by the room has become more and more popular and can increase the rent a property can get on the whole. Companies like PadSplit can help automate this process.

Charge for Amenities

If you do not charge pet rent and a nonrefundable pet deposit, you need to. At the same time, make sure to charge and actually enforce late fees. If a maintenance issue was caused by a tenant, have a thick skin and charge them back for it.

In addition, there may be other sources of income you can try to get. We have played around with offering lawn mowing services, rental washers and dryers, and the like. So far, we haven’t had a ton of success there, but we have gotten a few takers and marginally increased our income. And every little bit counts.

Supplement Rental Income With Other Endeavors

For investors, focusing more on flipping or wholesaling right now to supplement cash flow is not at all a bad idea. The same goes for those who are real estate agents or contractors.

In fact, this is one of our main strategies right now. We started our own construction and HVAC company for third-party clients in the Kansas City area, as we don’t have as much work to do in-house as we used to. We think we built a great system for scoping projects and overseeing rehab, and can charge less for HVAC, given our infrastructure is already in place, so this seemed like a natural way to grow our business and address our greatest need: cash flow.

A friend of mine, on the other hand, opened up a real estate brokerage, a mastermind group, and a DSCR lending company. Another does hard money loans.

Does it make sense to focus on other areas or grow your business in a new direction? These are questions you should be asking.

Bonus: Homeowners

I will finish off with one last tip for homeowners who need to move. This is very tricky, given that the same amount of money with a pre-2023 loan will buy a much bigger and better house than a post-2023 loan, due to how much interest rates have gone up since then.

My biggest recommendation for those who need to move but are sitting on 2%, 3%, and 4% mortgages is to hold on to those mortgages with your life! That kind of debt is just too valuable. Instead of selling your current home and buying one elsewhere, rent the one you own, and if you can’t buy elsewhere under those circumstances, just rent.

It may seem odd to rent a house when you own a rental, but who cares if it’s odd? It makes much more financial sense than selling a house with a 3 percent loan just to buy a smaller one in a worse area with a 7% loan.

Analyze Deals in Seconds

No more spreadsheets. BiggerDeals shows you nationwide listings with built-in cash flow, cap rate, and return metrics—so you can spot deals that pencil out in seconds.